Our history

The restructuring of the Trollhättan canal and hydro power plant under the Swedish State Power Board marks the birth of Vattenfall. The Swedish state had bought the water rights in Trollhättan a few years earlier and was now taking an active involvement in this emerging electricity generation technology.

Vattenfall is said to have been the world's first state-owned power producer. The journey to reach that point was lined with social debates and legal processes, and a large dose of entrepreneurship.

A new way of living

The introduction of electricity into the home changed the way people lived. Electric lighting changed the rhythm of daily life. Heavy manual tasks disappeared from household work, which was of huge significance – especially for women.

History of hydropower

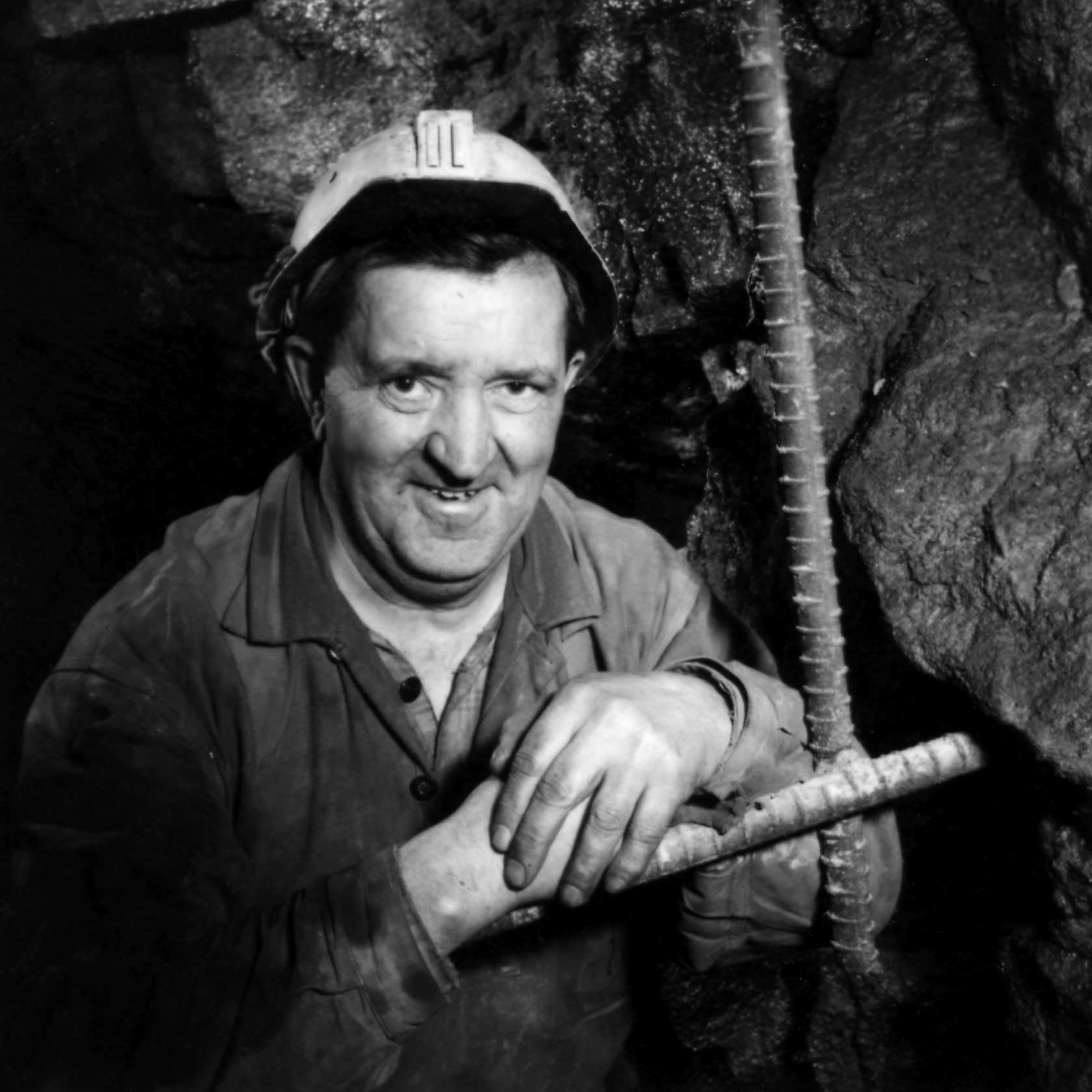

During and after the Second World War, the demand for electricity increased dramatically. Hydropower had to be expanded at a furious pace. This was possible thanks to the water rights that Vattenfall had acquired with foresight much earlier.

The development of nuclear power

When the development of nuclear power began, Vattenfall experienced a boom in new construction. The work sites at Ringhals and Forsmark power plants were the largest in the Nordic region at the time.

The evolution of wind power

It took many years before wind power went from being just a promising resource to being an established energy source. Sweden's first pilot project literally ended with a bang. Today, Vattenfall is one of Europe's leading producers of wind energy.

From fossil fuel to wind after 2000

In the early 2000s, renewable energy was on the agenda. But it took time for Vattenfall to shift from investment plans dominated by fossil power to a situation where renewable energy is the path to growth and expansion.

The history and heritage of Vattenfall

There are many more stories to tell, from the company's beginnings right through to today.

Related content

Vattenfall is a leading European energy company.

Vattenfall has formulated a strategy to reach our goal of fossil freedom.

Learn about our strategic and financial targets.